YEL Insurance – What Exactly is It?

Please note, that the numbers in this post will not be updated yearly. To check the up-to-date YEL limits, please head to our FAQ.

YEL is a pension insurance for all entrepreneurs.

After 1 May 2017, all self-employers (like UKKO.fi users) who earn more than 7 645,25€ (year 2017) through a billing service per year and whose self-employment activities last for minimum of 4 consecutive months, are transferred under the YEL insurance.

YEL insurance is compulsory and the percentage is the same for all entrepreneurs. UKKO.fi makes the YEL-payments to Varma based on the income estimate you give in your own control panel.

All salaries paid before 1 May 2017, still belong under the TyEL-insurance, which has accumulated pension as well.

YEL income

When you work as an entrepreneur, pension accumulates based on the income level you estimate and inform yourself. Please note, that this income level is not the same as your taxable income from self-employment. According to the official definition, it is the sum that you would pay as annual salary to someone with the same job.

This taxable income is, however, applied as a reference when estimating the minimum YEL-limit (7645,25 € in 2017) for light entrepreneurs.

The taxable income of light entrepreneurs approximately matches the amount of the YEL income, which is why it works as a good estimate.

You should be as realistic as possible when estimating your YEL income, as this is what determines your accumulated pension. It also affects your social security. If you’re having trouble with estimating the amount of your YEL income, you can always contact our customer service – they will be happy to help you.

With UKKO.fi you can update your estimate as often as you feel necessary. This can be done easily through your own control panel.

Between YEL and TyEL

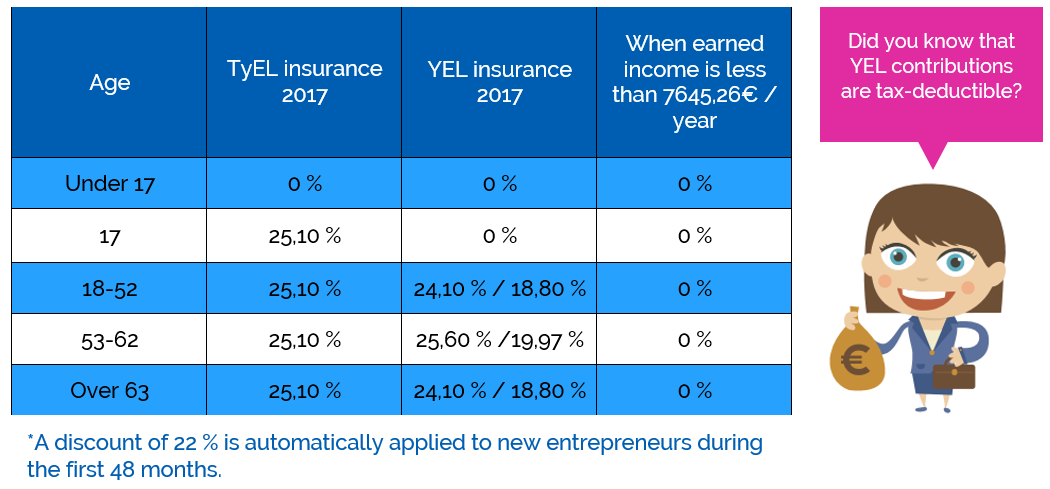

The amount of YEL insurance contributions is approximately the same as TyEL insurance, which in 2017 is 25,10%.

With YEL the same percentage in 2017 is:

- 24,10 % – aged 18 to 52 and over 63

- 25,6 % – aged 53 to 62

For new entrepreneurs, a discount of 22 % is automatically applied during the first 48 months, which means that the YEL-payment is either 18,80 % or 19,97 % due to the transitional provision. When transferring from TyEL to YEL, the entrepreneurship is seen to have started during the transfer – in other words 1 May 2017 the earliest

Since the beginning of 2017, entrepreneurs accumulate 1,5 % pension from YEL income every year. Due to the transitional provision, the accumulated pension of entrepreneurs between the ages of 53 to 62 is 1,7 of YEL income. This age group also has a slightly higher YEL-insurance payment, as can be seen from the picture above.

UKKO.fi will still take care of all the bureaucracy, just like before

If your yearly income, meaning the taxable income from all the work you have done as a light entrepreneur, is less than the YEL-limit (7645,25 €) you don’t have to inform this.

If the terms of YEL-insurance do not fulfill on your part, you don’t have to pay the pension insurance. Essentially this means that you will receive approximately 24 % more pay as a light entrepreneur.

While it is unfortunate that those without an YEL-insurance will no longer accumulate pension through our service, it’s good that you will now receive the entire amount to yourself. This means that you can self-plan your pension as you best see fit.

YEL insurance is mandatory for light entrepreneurs whose YEL income is at least 7645,25 € (2017) during a period of 12 months. The total YEL income is therefore looked at as 12 months forward – not as a calendar year.

In addition, these terms must be fulfilled for you to need the mandatory YEL-insurance:

- You are self-employed and between the ages of 18-67

- Your work is continuous during a period of 4 months

- You’re not already drawing old-age pension

If you continue as light entrepreneur while simultaneously drawing old-age pension, YEL insurance is voluntary.

YEL insurance is not granted to self-employers over the age 67.

Not able to estimate your taxable income? There’s no need to worry. The YEL insurance can also be taken in retrospect. The insurance must, however, be taken within 6 months of when the criteria above have been filled.

YEL insurance contributions are tax-deductible

As an UKKO.fi user you can take out YEL insurance easily in your own control panel or by contacting our customer service. Authorized by the light entrepreneur, UKKO.fi will take care of collecting and paying the YEL contributions to Varma.

This way you can be sure that all the payments are taken care of as needed and in accordance to the amounts you have given.

The payments are made every six months, in June and at the end of the year. YEL contribution is collected from your taxable pay among every invoice, after which the collected amount is transferred to Varma.

As YEL contributions are made from UKKO.fi users own income, they are still tax-deductible in your personal taxation.

The work you do as a light entrepreneur doesn’t accumulate the condition for previous employment when you are a part of an unemployment fund. As a light entrepreneur you can, however, join the unemployment fund for entrepreneurs. During a period of 18 months it is possible to be part of both funds.

According to the Unemployment Security Act light entrepreneurs have, since the beginning of 2016, been classified as entrepreneurs. This is not affected by the recent change to YEL insurance.

In terms of unemployment benefits, the most critical part is in the assessment of the nature of your entrepreneurship, in other words, whether it be full-time or part-time.

The goal of UKKO.fi is to make the bureaucracy lighter so that billing for the work you have done is easy. Our service has decreased black economy and made it easier for many to transfer into working as full-time entrepreneurs. It is our goal to make light entrepreneurship as easy as possible, also in terms of retirement insurances.

Still wondering about YEL or simply wanna know more? Go check out our FAQ-section for the most common questions. You can also always contact our customer service either via email asiakaspalvelu@ukko.fi or phone 09 6980 934 (mon-fri 8-18).

Do you want to get more general facts about light entrepreneurship, being self-employed or UKKO.fi´s invoice service for freelancers? Then click on the word you want to read more about.