Establishing a limited company easily

Establish a limited company easily through the UKKO Entrepreneur service along a clear guided path.

Establishing a limited liability company is this easy:

Fill in the new company information during registration

Come up with a name for your company, decide on the industry and fill in the basic information, and the necessary documents will be created automatically.

Sign the foundation papers, we will submit your application to the Trade Register

We send the incorporation papers to the e-mail of all shareholders for signature.

Connect your business account and you can start invoicing!

Open a bank account for your limited company when the trade registration is complete and connect it to your customer account. You are ready to invoice!

The benefits of a limited company – 4 good reasons to establish a limited company

1. Growing a business is easier

If you plan to grow and expand your business, a limited company is the best and sometimes the only option. A limited company can grow in many ways: the company’s ownership base can be expanded by taking on new shareholders, its business operations can be made more efficient by hiring employees, or different business and earning models can be developed for it without having to think about their effects on the company form.

In addition, you can collect funding or apply for a business loan more versatile and easier than as a representative of other types of business!

2. Financial planning is more precise

A limited company offers excellent opportunities to plan both your business and your own personal finances and their taxation. With good planning, you can save a lot of money!

As an entrepreneur, you can decide whether you pay yourself a salary according to your personal tax rate or whether you distribute dividends from profits with lighter taxation. You can also save the profits on the company’s balance sheet in case of possible worse times, for larger acquisitions, investments, or development projects.

3. Personal risks are lower

If your company has a lot of cash flow, and you don’t want to be responsible for your company’s finances with your personal assets, a limited company may be the best solution. In a limited company, the financial risks of business are directed to the independent company, and not to the entrepreneur’s personal finances.

The entrepreneur is liable only to the extent of the initial capital invested. The limited company is responsible for its own debts as an independent legal entity, and the entrepreneur’s personal liability is therefore smaller.

4. Your company’s credibility is stronger

For a small entrepreneur, credibility in the direction of customers, partners and potential financiers is of paramount importance. The limited company acts as a marketing tool, strengthening the credibility of your company. It shows that you are serious about your business and, if necessary, you can, for example, hire additional hands for your client’s assignments.

Credibility issues are particularly emphasized in situations where you do business with larger companies, pursue large contracts, or continuously acquire new customers without an established customer base.

Establishing a limited company in stages

Through the UKKO Entrepreneur service, establishing a limited company is easy. By registering for our service and selecting the Start company establishment button, your path to becoming a limited company entrepreneur begins.

Notice of establishment of a limited company

Through our service, you can fill in all the necessary information for the establishment application of your limited company, our service guides you through the steps. In connection with the establishment, the following information must be provided: Entrepreneur’s information, name of the limited company, industry, board members, possible choice of CEO, owner information, number of shares and, in addition, the willingness to join the VAT and tax pre-payment registers. When you have filled in the information and checked it carefully, you are a big step closer to starting your new business.

You will be sent the documents of incorporation for electronic signature usually no later than the next business day, and you will also receive payment information for the trade registration fee related to the establishment of your limited company. The size of the official fee for limited companies established through the UKKO Entrepreneur service is 280 € (incorporation done electronically) or 370 € (incorporation done with a paper form) and you can deduct it as an expense for your company to be established. Send us the receipt for the payment as soon as possible so that we can get your establishment application on the way.

Registration of a limited company

Applications to establish a company are processed by the Finnish Patent and Registration Office (PRH), and you will receive a message from our service when your company’s business ID number has been created. This usually takes 1-2 weeks. To operate as a limited company, you also need a company account for your company. The easiest and the fastest way for an UKKO Entrepreneur to open a company account is to get UKKO Business Account. You can do it here.

Opening a business account at the bank often requires the completion of trade registration, which may take up to 1-2 months depending on the patent and the processing status of the registry office. You can track the status of your company establishment in the Virre information service, and you will receive a message from PRH about the completion of the trade registration.

If you decide to get a business account from your bank, we recommend contacting the bank so that you can ensure the more specific bank-specific conditions for opening a business account, while you are waiting for your application to be processed. The UKKO Entrepreneur service is compatible with the following banks: OP, Nordea, POP Pankki, Säästöpankki, Danske Bank, Ålandsbanken, Handelsbanken, Holvi and Revolut.

Once you have opened your UKKO Business Account or business account in your bank, you are ready to start your own business. Just log in to our service, connect your business account and you can start invoicing right away!

What kind of limited company is UKKO Entrepreneur suitable for?

If you already have a limited company

You can join the service directly if you already have a limited company. The free 30-day trial period of the service starts immediately or when the contract with your previous accountant, if any, has ended.

If you want to establish a limited company

Through the UKKO Entrepreneur service, you can establish a limited company or change your form of operation from a business name to a limited company. Also, when changing the company form, you must establish a new limited company.

The service is suitable for you when:

- You have a limited company or are about to start one

- You want unlimited invoicing

- You want to focus on doing business and outsource bookkeeping to experts

- You want to pay yourself a salary and let us make it easy

- You want the financial statements and tax returns made by experts

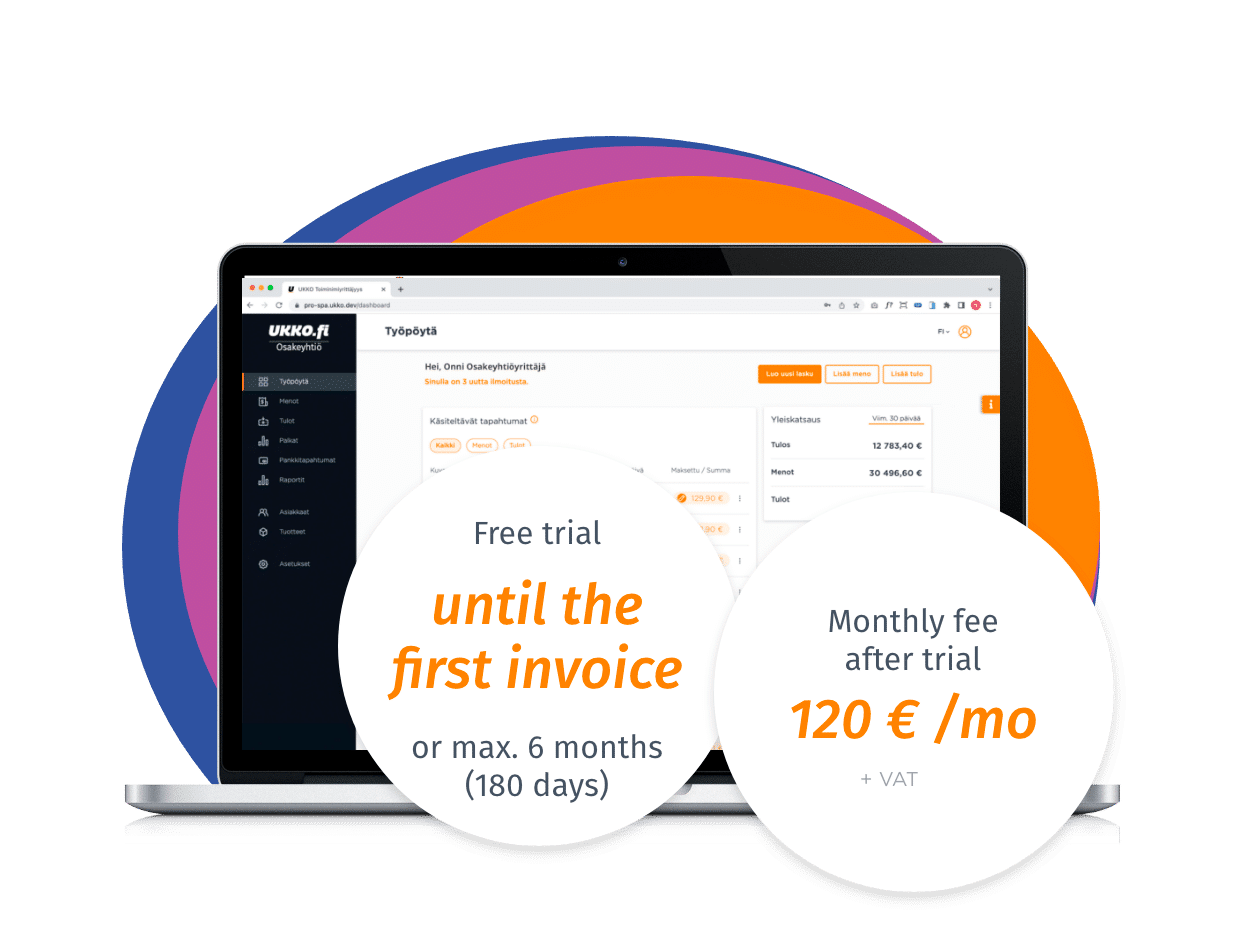

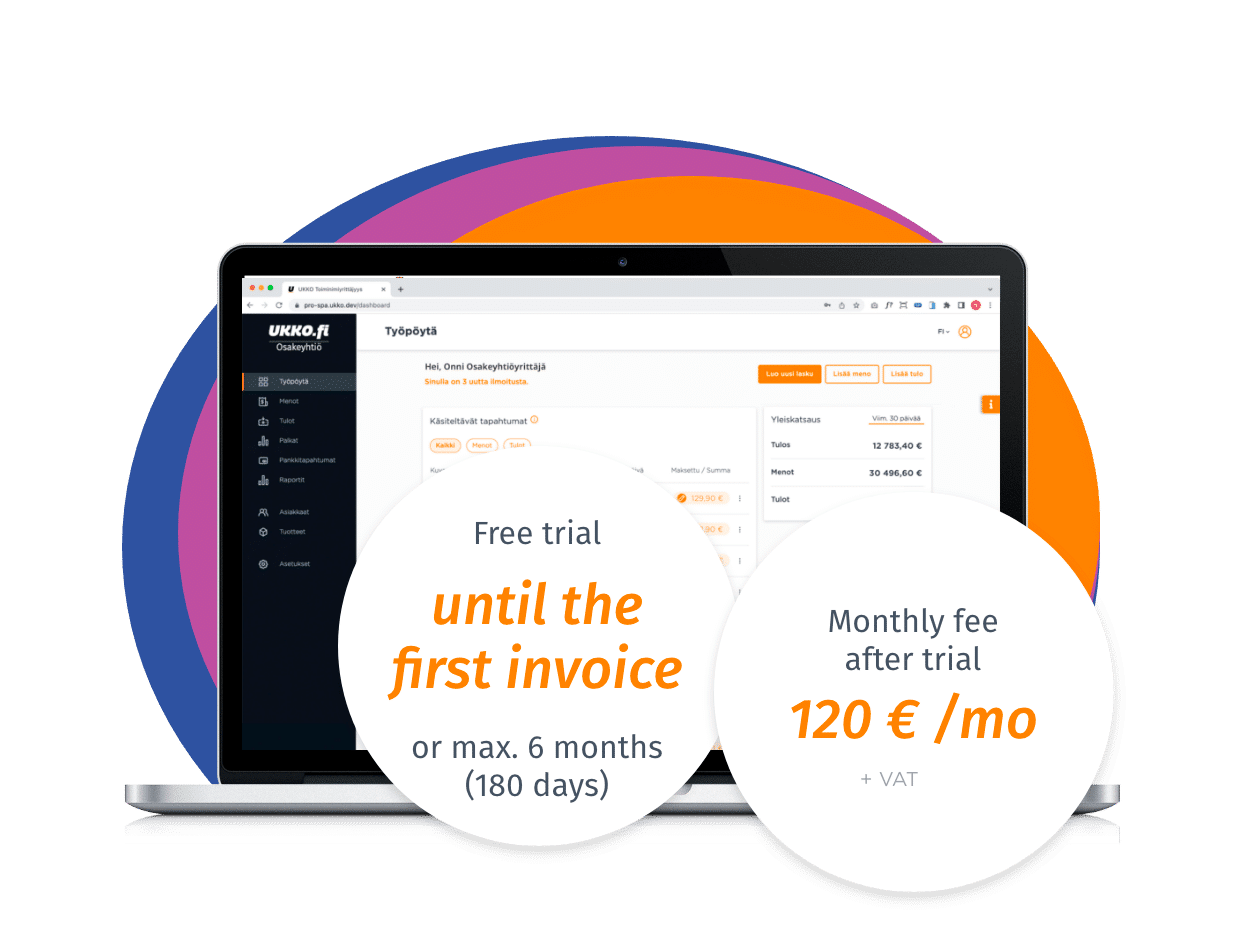

- You really want a fixed monthly price, only 120 €/month

Restrictions in the UKKO Entrepreneur service:

- We do payment-based bookkeeping for our customers

- Companies that operate through us must have one owner

- Invoices are processed only in euros

- We do not support agriculture and forestry

- We do not support activities related to animals

- Any employee payrolls must be handled by yourself, of course we handle the bookkeeping

Does the service sound suitable for you? Great!

What does the UKKO Entrepreneur service include?

You know what you are paying for and what is included in the price – no surprise costs

Our affordable monthly price includes the limited company’s bookkeeping, invoicing, authority notifications, financial statements, payment of the entrepreneur’s salary and other handy features that facilitate invoicing, adding receipts and monitoring your finances.

Starting entrepreneur: you only pay for the service when you send the first invoice

We want our pricing to support small entrepreneurs starting out. As a new entrepreneur, you can use our service for free for up to six months. You don’t have to pay anything unless you invoice your customers or generate revenue during that period. We want to encourage entrepreneurs and have therefore made the initial steps as easy as possible for entrepreneurs.

If you establish a new limited company, you will only have to pay an official fee at the time of establishment; the fee is 280 euros if the establishment is done electronically, and 370 euros if it is done using a paper form. You can deduct the official fee as a business expense immediately after establishment.

Contact us

Jimi Forsman

Sales Representative

+358 50 434 7273

jimi.forsman@ukko.fi

Miro Tiala

Sales Representative

+358 50 460 2442

miro.tiala@ukko.fi

Book a 30 minutes demo of UKKO Entrepreneur service

See for yourself how easy it is to manage things when the entrepreneur is at the center of the service!

The demo does not bind you to anything.

Private trader and limited liability company – When is a limited liability company a more suitable option?

Private trader and limited liability company are the most popular business forms in Finland. Establishing a limited liability company became significantly easier in 2019, when the share capital requirement of 2,500 euros for establishment was abolished.

Are you considering a business between a limited liability company and a private trader? Here are a few points on when a limited liability company could be more suitable:

- Your business activity is full-time and continuous – not just temporary and/or part-time

- You are aiming for the growth of the company and plan to hire employees

- When the company’s operations are large and it starts to involve more risks; a limited liability company is more functional in terms of risk management and provides more security. Risks are brought about, for example, by large acquisitions and expensive contracts

- When the company’s income is growing; a limited liability company is the most flexible company form in terms of profit distribution and tax planning

- A limited liability company allows shareholders and investors to get involved; this makes it easier to obtain financing. Working with partners can also be easier

- The fact that the company’s name ends with Oy and not tmi can have a significant impact on its credibility in its own field

Of course, running a limited company involves more bureaucracy than a private trader, but don’t worry! UKKO Entrepreneur is here to support you; in addition to the company’s accounting, the service also handles invoicing, official notifications, financial statements, paying the entrepreneur’s salary, and gives you access to other features that make your entrepreneurship easier.